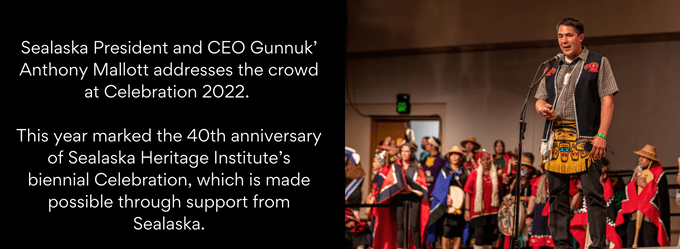

From the Sealaska Shareholder Newsletter: Management Report from President and CEO Anthony Mallott

Last May, the shareholders of Berkshire Hathaway gathered in Omaha, Nebraska to hear from the company’s legendary CEO, Warren Buffett, about the economic climate of 2022. Market swings, supply-chain bottlenecks, fears over inflation, rising interest rates and a possible recession make many investors wish for a crystal ball, and Buffett is known as the “Oracle of Omaha.” But what he had to say was incredibly practical and — even though Berkshire Hathaway and Sealaska have little in common — offers some interesting and applicable lessons for Sealaska shareholders wondering what to expect from distributions and the company’s performance this year.

Our Government Services businesses are setting up for one of their best years in recent history thanks to big increases in government spending designed to combat inflation and help Americans rebound from the pandemic. Earnings from these businesses offer us good diversification from our other income sources and they will be an important cushion against potential declines in other areas.

We are also aggressively pursuing opportunities in the

We are also aggressively pursuing opportunities in the

offshore wind energy sector. Sealaska is investing in technology, infrastructure and expertise to take advantage of what is expected to be a decade of massive growth for offshore wind energy. Improvements in offshore wind technology are decreasing

the cost of energy produced by offshore turbines, and more projects are being approved as a result. Several states have specific goals for the number of megawatt hours of offshore wind energy they will purchase in the coming years. Our focus is on engineering the undersea infrastructure that will enable this growth, and we are poised to build in waters around the United States and Europe.

We expect the performance of our investments to drop significantly in 2022, a reflection of the turbulent global financial markets. While this is frustrating, it is a characteristic of financial markets that there are occasional down years. This is to be expected.

It is likely that inflation and supply-chain challenges will negatively impact the performance of Sealaska’s food businesses this year. Our foods businesses are primarily oriented toward consumers, and we have some excellent, well-marketed brands. But with inflation now at 9% and climbing, seafood is becoming increasingly expensive and it’s logical to expect an impact on sales. Global supply-chain issues are also creating challenges in getting our high-quality, sustainable products to market.

The other major impact on our net income — at least on paper — is that Sealaska will not record any income from carbon projects in 2022. The structure of the deals we signed with the California Air Resources Board when the projects came online in 2018 was that all the income would be recorded in the first 3-4 years of the projects. That time frame has now expired. However, we are working on several new carbon projects that will turn this revenue stream back on soon. More importantly, shareholders and communities will benefit from carbon income we’ve already brought in for decades — if not centuries — to come.

Carbon has produced about $140 million in income for Sealaska, and we’ve invested large portions of it in shareholder benefits programs that are intergenerational in nature. Examples include our $10 million language fund, $10 million investment in the Seacoast Trust and, in April, the addition of $25 million to the Marjorie V. Young Shareholder Permanent Fund (see pg. 6). This $25 million investment will help insulate shareholders from inevitable market swings and the impact of new shareholders on distributions.

All of this brings me back to Warren Buffett, and what shareholders can take away his comments to Berkshire Hathaway shareholders in May. Buffett warned them not to treat the markets like a casino, and not to be fooled by get-rich-quick schemes. Even Buffett, a billionaire many times over, doesn’t expect outsized returns.

Instead, Buffett told investors to keep cash on hand to weather the challenging months ahead. Thanks to our carbon projects, Sealaska has savings that can be deployed as needed to weather this uncertain period. Unlike many publicly traded companies, we will continue paying dividends during this time, and our shareholder benefits spend will remain stable.

Buffett’s final piece of advice is particularly applicable to us: “The best thing you can do is to be exceptionally good at something,” he said. “Whatever abilities you have can’t be taken away from you – they can’t actually be inflated away from you.”

For nearly a decade, Sealaska has been increasingly focused on our business vision for Ocean Health. It is a vision that aligns with our Tlingit, Haida and Tsimshian values, and we’ve spent years honing our expertise in this area. Inflation and turbulent markets may impact us for the short term, but in the long term, we know we’re on the right path for the right reasons and nothing can take that away from us.

Back to Stories

Back to Stories

Previous

Previous